It’s been a historic month, seeing a new president of the United States, a new all-time-high for bitcoin, renewed passion by those that have been in the space, and all-new interest in the industry from many others. So, without further ado, let’s just jump right in…

The Trump Effect

Donald Trump, a vocally very pro-crypto candidate, won the 2024 presidential election. This is not news. What is news is that the crypto markets responded feverishly. We saw bitcoin make big moves indeed, going from $68,000 right before the elections to an astonishing peak of $99,500 per bitcoin in just a few short weeks. This “Trump Effect” seems to be throwing gas on the fire of the already escalating bull season which is driven by global macro. He is clearing the way for not only bitcoin, but innovation in general. Something that has been sorely lacking here in the US. And it’s not just Trump. We now have over 219 pro-crypto representatives elected to the House and Senate, a milestone indeed. FairShake, a huge crypto Super-Pac that had amassed $245 million, certainly seemed to get the job done. This gives us something the USA has never had. A crypto friendly president and a crypto friendly congress – which is expected to lead us into a very, very crypto friendly USA. Given this, it’s easy to see that bills that were derailed this past year, such as FIT21, the bi-partisan crypto regulation bill, should easily pass now. This is the beginning to regulation the industry has been asking for. This will open the door for the future.

In the weeks right after the election Trump has already started to make moves, beginning with the Department of Government Efficiency (DOGE). Elon Musk will be co-leading DOGE along with Vivek Ramaswamy, designed to, well, promote efficiency. No coincidence that the agency is named DOGE, as a nod to the famous meme coin Dogecoin. (You can’t make this stuff up). Could there be any clearer signals? Well, actually, yes! As a welcome announcement, SEC chair Gary Gensler has already resigned and will be leaving his post on January 20, 2025. This was one of Trump’s seminal campaign promises to the crypto community as, notably, Gensler has basically led a one-man war against crypto since his inauguration in 2021. This ends four years of basically hellfire and brimstone for those trying to move the proverbial crypto pebble forward. It also clears the way for a much friendlier chair, which can only move us closer to having innovation embraced over this next term. This is the key point here. Blockchain, the foundation of all crypto, is technical innovation, and if we are going to really thrive and be competitive in the next decades, we must embrace it. Looks like we finally are.

And, if that’s not enough, there are talks of the US actually opening up a bitcoin strategic reserve. Senator Cynthia Lummis of Wyoming introduced the BITCOIN Act of 2024 which has language for the US to acquire ONE MILLION bitcoin over a five year period. (Just writing that gave me shivers.) Scott Bessent, Trump’s nominee for Treasury Secretary is in support of this as well. The impact of this cannot be overstated. If that plan is actually enacted that would put the United States on a path to control 5% of the world’s bitcoin. This would, at current values, be approximately 10 times the value of gold we hold in our treasury (and we expect in 5 years the price of bitcoin to be much, much higher). Of course, it will also send a signal to other countries that it is time for them to start putting it in their treasuries and, well, the rest is self-evident. Simply, we’ll have unprecedented demand for a finite asset…. Need I say more?

MacroStrategy

Meanwhile, Michael Saylor, just upped his game. Again. This time he purchased $2 billion of BTC on November 11, then doubled down literally and bought another whopping $4.6 billion on November 18, at then-high prices of $89,000. There’s no secret to his strategy. It’s not Micro. It’s big. It’s bold. It’s “Buy Bitcoin” at any price. It’s Macro in every sense. As of November 25, 2024, Bitcoin was trading at approximately $95,450 and, with MicroStrategy holding about 386,700 bitcoin. Saylor has spent approximately $21 billion to acquire these coins and the total value of their holdings stands at approximately $37.6 billion. Just… wow.

This would be enough for most, but he is not stopping. Saylor has outlined an ambitious plan to significantly increase the company’s bitcoin holdings over the next three years. This initiative, known as the “21/21 Plan,” aims to raise $42 billion—comprising $21 billion from equity offerings and $21 billion from debt instruments—to acquire additional bitcoin. This is double the amount MicroStrategy has spent to date, and prices are at all-time highs. Look, I have conviction. This man has something more. It is conviction dipped in conviction then coated in titanium.

Worth noting, people constantly ask me “did I miss it?” Well, I suppose that depends on your horizon. Bitcoin went from $0.01 to $99,500 per coin. That’s an unfathomable 995,000,000% gain. That’s never going to happen again. So, yes, you missed that (if you did). And, indeed, in this cycle as well, the biggest expected moves for bitcoin have happened already. But, if you’re looking five years or 10 years down the road… probably not. Michael Saylor certainly doesn’t think so.

So, Did I Miss it? (Yes. And No.)

As noted above the days of bitcoin in the pennies, hundreds or even thousands of dollars are long gone. In fact, after this current cycle completes, I’m not sure we’ll ever see bitcoin below $100K again. But there is still opportunity for gains in the short run that should exceed bitcoin’s as we enter the last year of this bull run. Of course, I’m talking about innovation assets. Alternative coins and tokens in the crypto space.

First, let’s talk about how cycles work. We’ve got plenty of data now as this is our fourth crypto cycle, and according to the data we’ve about 16 months to go from here before the expected pivot back to a bear. Over that period of time, I would put a price target of approximately $200K on bitcoin or, said differently, about 100% gain from this point forward. We have confidence in this not only because of past cycles, but because we see the crypto markets are really tied into global M2, and we don’t expect this liquidity cycle to peak until early 2026.

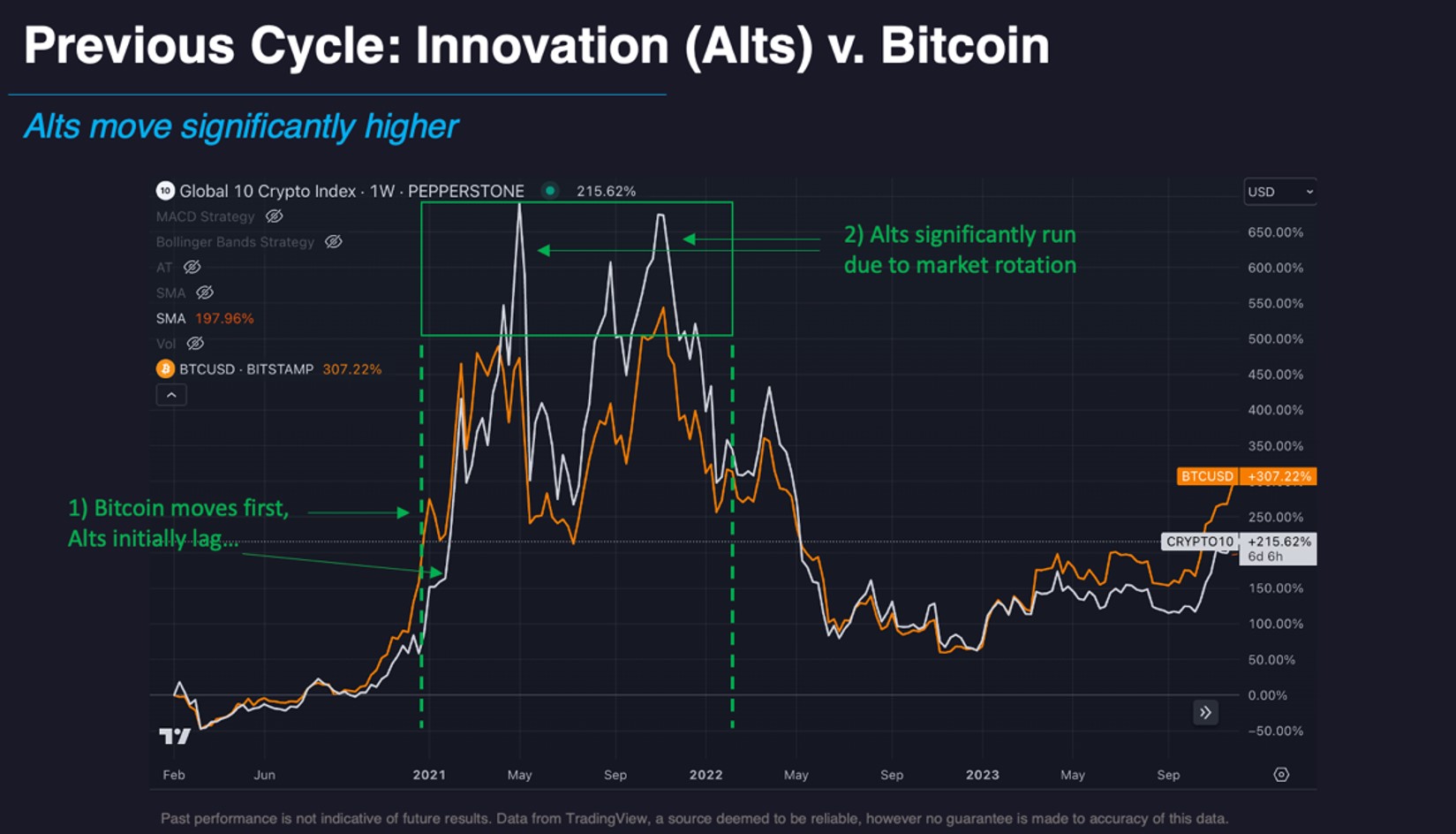

So, we do expect a more growth, but at a slower clip. And that’s when a funny thing happens. There’s this thing called “Bitcoin Dominance” and it denotes how much of the crypto market cap is made up of bitcoin. During the last year of each bull run, historically, bitcoin dominance fades. This is because (oversimplifying) money that was in bitcoin rotates into alternative crypto assets (anything other than bitcoin), and they tend to move harder and steeper while bitcoin’s growth slows down. This is “Alt-Season”. And it’s coming.

This is the area that we focus on at Tradecraft because it’s harder to get right, but vastly more rewarding in the back half of the crypto cycles. With bitcoin as the leading indicator, all roads proverbially cleared by Trump, and global liquidity in our sails, the stage is set. If history proves itself out we expect to see rotation begin in Q1 2025 and peak later in the year. We saw this very clearly in the last cycle, from late 2020 through early 2022 (see below.)

This corresponds to exactly where we are now in this cycle and, while past performance is never a guarantee of future performance, we see all the indicators lining up eve better than last cycle. So then, from now through early 2026, it’s possible that we will see some alternative crypto assets double, triple or quadruple bitcoin’s performance. Or even more. Now, this does not mean that every alternative will perform. Some are amazing. Some are absolute garbage. In fact, most of the alternatives in the market are not long term viable in our opinion, so one must be cautious. I do NOT recommend you buy an altcoin or token because a friend, colleague, lover, or uber-driver recommended it. I DO recommend that you do your own homework. Look for technologies that are really differentiators. Understand what they are and what they do. Understand where they will fit into the ecosystem. And really pay attention. Because at the end of the day the choice alternatives are the innovation stack, and innovation is where wealth can be multiplied.

So, the answer to “did I miss it this cycle?” is no, not as long as you are positioned correctly in alternative crypto assets. If you are, you may be able to take advantage of the next legs of this historic run.

In Closing

The US political environment is finally shifting and becoming crypto-friendly. Macro winds are blowing in our favor with the expansion of the global monetary supply. And the best performing part of the bull run, “Alt-Season,” is in front of us. So, for those of you that have been waiting, I argue your wait is over. There will never in our lives be a time with this much opportunity in front of us as investors with so little risk on the table. So yes, be wise. Do your homework. And keep your eye on the cycle so you don’t get fooled by the inevitable volatility which, ultimately, is our friend in these markets.

That’s all for now. Until next time be well, stay safe, and I’ll keep Decrypting Crypto for you!