“Haters gonna hate” is a common phrase nowadays. It wasn’t always, but what was once an underground meme got hyper-popularized in the 2014 pop song “Shake It Off” by Taylor Swift and now, well, it’s part of our lexicon. In accordance, bitcoin and top crypto assets are certainly shaking it off this year, with gains in some cases of over 50%.

Even so, we already know that “Haters gonna hate.” This is true in any field. No matter who you are or what you do, you’ll have detractors. That doesn’t mean they are the truthsayers, by the way. Simply that they are anti, often for no justifiable reason. Nowhere, however, is this truer than in the world of crypto, the industry that everybody seemingly loves to hate.

Yet, here we are, in a boom period with big gains so far in Q1. There are a lot of reasons for this but let’s look at – and through – some of the doom-and-gloom news.

Regu-Late

Accordingly, importantly, and about-damn-timing-ly, in the wake of 2022 it seems that regulators are actually going to start regulating. It’s late but it’s here. I’m going to take a perhaps unpopular view inside this space and say that this is actually a good thing and, unfortunately, needed. In any new technology space, there are always excited entrepreneurs, bold ventures, spectacular failures, and boundary pushers. The world of blockchain and crypto is no different, but it’s clear we need some guardrails. It is unfortunate that we have to have an FTX-style event for this to occur. In any event, however, it did. We’re now here. Of course, then we have the banking crisis – which in and of itself is a case for crypto. So, while the “Haters gonna hate,” we now see that “Regulators gonna regulate.”

Let’s dive in.

Choking on Choke Point

What a spectacularly dramatic name, one set to strike fear into the hearts of as many people as possible. And there are plenty of crypto-pessimistic articles about this, pointing to the fact that the US government is going to war against crypto. It’s true that banks taking deposits from crypto clients, issuing stablecoins, engaging in crypto custody, or seeking to hold crypto as principal have faced nothing short of an onslaught from regulators in recent weeks. Consider, however, that it’s enforcement of some pretty common-sensical banking principles designed to promote stability in the banking system. Choke point points to the fact that regulation is going to be enforced. If enforcing regulations is war then, ok, it’s war and, look, I’m no fan of regulation by enforcement. But let’s move through the hype and explore what this really means.

As noted in this Forbes article by Gene Grant II, CEO of LevelField, “The experience of non-banks offering banking-like products in the cryptocurrency space has not ended well… When the banking regulators look at these firms the lesson, they take away is that the banking system must be protected from firms not managed in a safe and sound manner.” Thus enforcement, which points to a few things. For starters banks can’t issue stablecoins. That’s probably for the best as banks should not mint their own money. There are stablecoin providers out there and an arm’s length relationship is always wise. Also, banks cannot hold crypto assets on their balance sheet. With the downfall of Celsius and FTX, this makes sense to me as well. Ultimately, I think this will evolve as the state of crypto evolves, but they are trying to minimize balance sheet volatility.

The SEC further leaned in by providing guidance on qualified custodianship and separation between those that invest assets and hold assets. Logically, this makes sense. We should have an arm’s length relationship between those that create assets, those that exchange assets, and those that are charged with custodianship, so I don’t have a particular problem with this either. Frankly, I’d prefer a qualified custodian (a bank or other entity that meets certain SEC guidelines for safekeeping of assets) holding my assets. In general, investors should do investor things, exchanges should do exchange things, and custodians should do custodian things – inside and outside of the world of crypto.

One of the concerns of “Choke Point” is that it’s going to make it hard for crypto companies to get banked. This isn’t new – it’s always been hard. But as industry players begin to adhere to regulation, I suspect this will get easier.

I need to hop back on my stump for a second and note that we need to separate this concept that crypto = money. You’ve heard me rant about this before. Yes, bitcoin is a money use case of blockchain but that’s the only one that we care about from a monetary standpoint. All else (that we care about) are fundamental technologies. Crypto assets give us the ability to engage with the chains in a liquid way and do many different things, including providing utility, governance, and representing goods.

Ironically, one of the real benefits of crypto is to do away with counterparties unless absolutely necessary, and none of this regulation takes away from the ability of each and every individual, should they so desire, to be able to hold their own crypto assets in their own wallets with their own keys. This regulation is to try to make the counterparties safer. Blockchain solved this by doing away with counterparties, but in the real world (at least today) we still need them.

Banks Tank

What. A. Month. Just this month, Silvergatebank, which was overly concentrated in crypto companies, had the proverbial “run on the bank.” A lot of this was from the abysmal 2022 that affected everyone and was compounded by the lack of trust from the fraud at FTX, but this is a case of a bank overweighted in one industry – nothing necessarily nefarious.

The world was shocked, however, when the venerable Silicon Valley Bank imploded. This too was a run on the bank, impelled (over-simplified) by many depositors wanting to get their money at darn-near the same time. This was not a crypto problem. This is a fractional reserve problem which amounts to this: Banks are the ultimate in leveraged institutions and on the whole banks don’t hold all of your money. They lend it out, invest it, etc. SVB did some conservative investing and didn’t do anything “wrong” per se, but a cash crunch, failed capital raise, and desire for individuals to earn 5% on their money via treasuries created a perfect – and almost immediate – storm. There are plenty of articles, such as this, on the topic so I’m not going to go on except to note that something then happened that changed everything. The Fed stepped in.

The central bank said it would make additional funding available to banks through a new “Bank Term Funding Program,” which will offer loans of up to one year to banks that pledge U.S. Treasury securities, mortgage-backed securities, and other collateral. Up to $25 billion from the Treasury’s exchange-stabilization fund will backstop the Fed lending program.

And, suddenly, the Fed’s balance sheet expands again. While this is not technically quantitative easing, it’s a whole bunch of liquidity injected into the system. And bitcoin ran. I postulate that this is for a couple of reasons. First is that bitcoin is a hedge against monetary inflation and, well, we now have more money in the system. Second, this is one of the reasons that we have crypto in general – the ability to control your own asset, money or otherwise. Bank runs aren’t new, but the concept that your money isn’t “available” when you may want it, is – to many people. Just as bitcoin was created as an answer to the financial crisis in 2009, it’s an answer to this crisis as well. In fact, if you want to take a look, DeFi protocols such as Aave or Compound are great examples of protocols that don’t require custodianship or over-leverage. The opposite of banks.

It’s going to take us some time to get used to the idea of software managing our money, but in my opinion, the SVB collapse – which is a non-crypto bank collapse – is actually a case for crypto.

Finally, let’s add some clarity to Signature. The same weekend SVB had issues, the Fed also stepped in and took over Signature bank with little reason or warning. There are lots of speculations and articles pointing out that this too was a crypto problem but, upon diving in, we see that this seems to be an issue that New York had with the management, as noted in this Reuters article. It goes on to address the comment that all crypto activities at the bank must stop, noting “an FDIC spokesperson told Reuters … that the agency would not require divestment of crypto activities as part of any sale.” There’s value in cutting through the noise, my friends.

Bullseye by Gartner

I’ll close with something that is simply not discussed much in the news. In the midst of all of this, the technology simply keeps advancing. Remember, blockchain technology is technology and big business (and big banks) are already adopting it. As noted last missive, Starbucks is using it for loyalty. Lowes for theft prevention. I’d like to add to that list by including FedEx for shipping. Mastercard for payments. Shell for energy. Roche for procurement. The US Air Force just made a $30M investment in blockchain. Even JP Morgan, with legendary naysayer Jamie Dimon, is testing trading on blockchain. The list goes on. And on. And on.

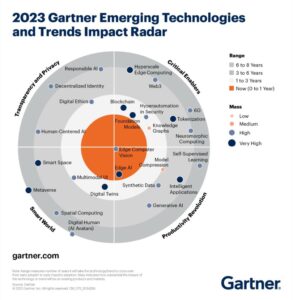

It’s no surprise that with all this adoption Gartner notes that we’re going to see real impact in 1-3 years.

This is why we are so bullish at Tradecraft. This is what is happening behind the scenes and underneath all the noise, and this is why we think all of this bodes very well for blockchain and crypto.

In Closing

History is only true from the point of view of the writer, so be sure to do your homework. My goal this month was to shed some additional light on these events and prompt you to dive a little deeper and consider that headlines (designed to get you to click) don’t often tell the whole story.

Regulators gonna regulate and, meanwhile, adopters gonna adopt. That’s how it goes and, in this case, I hope you see that regulation is not necessarily bad and adoption, well, is very, very good.

Ending on a lighter note, I have to say that even in the generally perceived good there are always nimbus clouds. To that point, Taylor Swift was sued in 2017 for plagiarism for the (in)famous “Shake It Off” from the group 3LW. I suppose we’ll never know the truth as attorneys for both sides filed for dismissal in December 2022, which seems to imply some kind of agreement was reached. This couldn’t illustrate the point better. In almost every industry haters just gonna hate but, at the end of the day, we must keep moving forward and shake it off.

That’s all for now. Until next time – be well, stay safe, and we’ll keep decrypting crypto for you!